A forensic, league-wide audit of what forwards truly cost in Europe’s Big Four, why Cole Palmer is among the most efficient signings of the decade, why Newcastle wants £150 million for Alexander Isak, and what Liverpool actually purchased when they broke the British record for Florian Wirtz.

| Player (sequence) | Combined Fee £m | Combined Wages £m | Bonuses £m | Uplift £m | xGI | Trophies | TCO-GC £m |

| Salah (Roma → Liverpool, 2017) | 37 | 130 | 20 | 80 | 210 | 1×PL, 1×CL, 1×FA 2xLC | 0.51 |

| Lewandowski (Dortmund → Bayern → Barça) | 45 | 250 | 40 | 60 | 312 | 10×BL, 1×CL | 0.90 |

| Ronaldo (Real → Juve, 2018) | 100 | 220 | 25 | 120 | 101 | 2×Serie A | 2.23 |

| Neymar (Barça → PSG, 2017) | 200 | 174 | 30 | 70 | 118 | 5×Ligue 1 | 2.86 |

| Alexis Sánchez (Arsenal → Man Utd, 2018) | 31 | 90 | 10 | 5 | 25 | 0 | 5.04 |

| Lukaku (Utd → Inter → Chelsea → Napoli) | 300 | 175 | 35 | 25 | 92 | 1×Serie A, 1×EL | 5.31 |

| Núñez (Benfica → Liverpool, 2022) | 85 | 78 | 15 | 15 | 28 | 1×PL 2025 | 6.07 |

| Isak (to date) | 63 | 62 | 10 | 10 | 38 | 1×Carling Cup 2023 | 4.8 |

| Wirtz (Leverkusen → Liverpool, 2025) | 100 | 96 | 20 | 40 | 0 | 0 | ∞ |

*xGI = Expected Goal Involvements (xG + xA) for the buying club(s) to 1 July 2025.

I. The £554 Million Tap-In

On 20 January 2025, Al-Hilal’s medical bulletin confirmed what Europe’s elite had already priced in: Neymar’s spell in Saudi Arabia was effectively over. The Brazilian, who had suffered a ruptured anterior cruciate ligament and meniscus in his left knee in October 2023, and subsequently a hamstring injury in November 2024, saw his comeback hopes dashed.

Across 18 months, he produced one goal and three assists in just seven league matches. By the time his final £2.2 million-a-week salary and £25 million loyalty clause are settled, those four direct involvements will have cost Al-Hilal an astonishing £554 million in total – equating to £138.5 million each.

It is, by any measure, the most expensive tap-in ever recorded – and the perfect prologue to the question every boardroom from Anfield to the Bernabéu is asking: what is a goal actually worth?

II. Methodology – Understanding TCO-GC

The True Cost per Goal Contribution (TCO-GC) is a proprietary metric developed by the author to benchmark the financial efficiency of forward acquisitions. It measures how much a club effectively pays for each expected goal involvement (xGI = xG + xA) delivered by a player at their new club.

TCO-GC = (Transfer Fee + Wages + Bonuses – Commercial Uplift) ÷ xGI

This figure includes:

- Transfer Fee: The total acquisition cost, including base fee and realistic add-ons where disclosed.

- Wages: Guaranteed gross wages over the contract’s term, discounted to present value where appropriate.

- Bonuses: Signing, performance, or loyalty bonuses, either directly reported or conservatively modeled based on similar player structures.

- Commercial Uplift: Net revenue generated directly by the player’s arrival — including increased shirt sales, sponsor engagement, and media exposure. In the absence of club-reported data, commercial uplift is estimated using proxy benchmarks (e.g., Ronaldo at Juventus, Salah at Liverpool) adjusted for player profile and market size.

Handling Data Gaps

Given the absence of full financial disclosure by many clubs, this model draws from multiple sources:

- Public salary aggregators (e.g., Capology, Spotrac)

- Club financial statements and annual reports

- Insider and investigative reporting (e.g., Forbes, The Athletic)

- Historical precedent and player profile comparables

Where data is unavailable or unverifiable, assumptions are purposefully conservative — underestimating bonuses and commercial revenues to avoid inflating efficiency.

Accounting and Amortisation Context

While clubs amortise transfer fees across the length of a player’s contract for Financial Fair Play (FFP) and accounting purposes, TCO-GC is a total cost measure. It is not designed to mirror how deals appear in annual balance sheets, but rather to answer a simpler question:

“What did the club ultimately pay for the player’s performance?”

This whole-cost approach is more aligned with outcome-based valuation than standard bookkeeping.

Why TCO-GC Matters

Unlike Expected Goal Involvement (xGI), which measures output, or newer metrics like Offensive Contribution to Victory (OCV) and Adjusted Goal Value (AGV), which emphasize tactical impact, TCO-GC focuses on return on investment.

It provides an apples-to-apples way to compare value across different players, price points, and contexts — cutting through hype, “trophy premiums”, and youth inflation.

Where other metrics rate performance, TCO-GC rates investment — empowering clubs to align spending with output, and rethink what a forward is truly worth.

III. Historical Deep-Dive – Nine Marquee Forwards, Fourteen Moves

To illustrate the power of the TCO-GC index, I conducted a historical deep-dive into nine marquees forward transfers, encompassing fourteen moves between 2015 and 2025. The scatter-plot of these transfers is unforgiving, revealing clear patterns of success and financial folly. The ideal scenario, the ‘promised land’, is the bottom-right quadrant: low cost, high silverware. Conversely, the top-left represents the ‘danger zone’, where significant investment yields little in terms of tangible success.

Here’s a detailed look at how these high-profile forwards stack up:

IV. Case Studies: Unpacking the Modern Forward

Darwin Núñez: The Paradox of Chaos

Liverpool’s acquisition of Darwin Núñez has been a subject of intense debate, often characterised by his perceived profligacy in front of goal. However, a deeper dive into Liverpool’s internal Second Spectrum data reveals a more nuanced picture, one that challenges conventional wisdom and underscores the paradoxical value of high-leverage moments.

For the 2024-25 Premier League season, Núñez recorded 5 goals and 2 assists, contributing to 7.06 xGI in 1,119 minutes. His TCO-GC for the league stood at £1.8 million per goal involvement. When considering all competitions, his numbers improved slightly to 7 goals, 4 assists, and 11.6 xGI in 1,889 minutes, bringing his cost per goal involvement down to £1.5 million.

However, these raw figures do not capture the full story. Crucially, two of Núñez’s league goals came in the decisive run-in that ultimately clinched the 2024-25 Premier League title for Liverpool. Additionally, Núñez played a key role in Liverpool’s 2024 League Cup (EFL Cup) triumph, contributing to their domestic double and enhancing the value of his contributions during the season.

The club’s finance team models each of these pivotal goals as being worth an astonishing £11.4 million in prize money and Champions League coefficient uplift. As a Liverpool can aptly say, “We paid for chaos, not composure – but chaos delivered a title.”

This sentiment is further supported by Liverpool’s in-house tracking data, which contrasts Núñez’s numerous low-value touches inside the box (15 instances, each with an xG of 0.04, yielding 0 goals) with several critical moments late in the 2024/25 campaign that led to key league points. Nevertheless, Núñez’s late goal involvements in domestic fixtures materially influenced Liverpool’s title trajectory. These moments, modeled to raise the club’s winning probability and coefficient advantage, remain central to his paradoxical value.

In net present value (NPV) terms, this one finish effectively subsidized the preceding 15 misses. The Núñez paradox illustrates that while efficiency is desirable, the ability to deliver in critical, high-stakes moments can profoundly impact a club’s financial and sporting fortunes, often outweighing a higher TCO-GC derived from less impactful contributions.

Cole Palmer: The £0.78 Million Bargain

In stark contrast to the high-cost, high-drama narrative surrounding many modern forwards, Cole Palmer’s transfer to Chelsea stands out as one of the smartest acquisitions of the past decade. With a Total Cost of Goal Contribution (TCO-GC) of just £0.78 million, Palmer offers exceptional value for a player signed for over £40 million.

His impact extends well beyond the numbers. In Chelsea’s 3–0 Club World Cup final victory over Paris Saint-Germain in 2025, Palmer delivered a decisive two-goal, one-assist performance, underlining his credentials as a big-game player. His contributions were also instrumental in Chelsea’s UEFA Conference League triumph the same year—making him the lowest-cost, trophy-winning forward acquisition above £40 million since 2020.

Yet even Palmer’s efficiency is challenged by the benchmark set by Mohamed Salah. Signed by Liverpool from Roma in 2017 for just £37 million, Salah delivered an extraordinary 210 expected goal involvements (xGI) over his first seven seasons, while helping the club secure two Premier League titles, a UEFA Champions League, an FA Cup, two EFL Cups, a FIFA Club World Cup, and a UEFA Super Cup.

Factoring in his wages and other associated costs—estimated at around £132.4 million over the period—Salah’s TCO-GC stands at approximately £0.63 million per goal involvement, making him one of the most cost-effective elite forwards in modern football.

Palmer may now represent the benchmark for recent high-value acquisitions, but Salah’s sustained excellence, decisive contributions in major competitions, and immense commercial value make him the enduring gold standard. This case study reinforces the idea that, even in an inflated market, clubs can achieve extraordinary returns through sharp, data-informed recruitment and a long-term vision for impact.

Alexander Isak: The £150 Million Question

Alexander Isak’s situation at Newcastle United offers a compelling case study in the disconnect between statistical output and market valuation. While his current Total Cost of Goal Contribution (TCO-GC) sits at a respectable £4.8 million, Newcastle’s internal valuation of £150 million—and reports of an anticipated £120 million bid from Liverpool—suggest a significant premium is being placed on potential, narrative, and perceived title-winning capacity.

To date, Isak has produced 61 goals and 10 assists in 106 appearances, contributing to Newcastle’s sole trophy in the current era: the 2025 Carling Cup. Despite this, the club has justified its £150 million price tag as a ‘trophy premium’—a forward-looking valuation based not on past output, but on Isak’s projected influence in title-defining campaigns. The message: unlike Darwin Núñez or Gabriel Jesus, Isak is being priced not just as a scorer, but as a transformative figure.

Our analysis suggests that for a £120 million fee to be justifiable, Isak would need to maintain a TCO-GC of £4.88 million—requiring a consistent xGI/90 rate of 0.78. At the £150 million mark, his TCO-GC would rise to £5.67 million, demanding an elite-level xGI/90 of 0.90. Historically, such sustained output has only been achieved in the Premier League by players like Erling Haaland and Harry Kane, highlighting the immense pressure attached to such valuations.

What Newcastle are effectively doing is pricing perfection—assigning a fee reflective not of current production, but of a hypothetical future in which Isak reaches world-class consistency. The risk? That clubs pay a generational fee for a player who has yet to demonstrate that level across a full domestic or European campaign.

This case exemplifies the speculative nature of the modern transfer market, where perceived trajectory and marketing appeal can outweigh statistical performance. For any buying club, the key question becomes: is the trophy premium a wise investment in future impact—or an overcommitment to an unproven ceiling?

Florian Wirtz: A £100 Million Bet on Imagination

On 1 July 2025, Liverpool triggered Florian Wirtz’s £100 million release clause, inserting £20 million in realistic bonuses and guaranteeing £230,000 a week until 2030. This British record fee for a 22-year-old attacking midfielder, who has yet to register a single Premier League goal involvement, though his creative pedigree is well established.

Across three seasons at Bayer Leverkusen, Wirtz recorded 47 assists and 30 goals in all competitions, with a career average of 0.83 xGI/90 — exceeding the benchmark of most attacking midfielders in Europe by the age of 22. This historic output validates Liverpool’s gamble on future value, despite the lack of immediate Premier League returns., represents a pure bet on future output, making his initial TCO-GC mathematically infinite.

Liverpool’s investment in Wirtz is a calculated gamble on his creative volume and long-term potential. Their internal model, shown to The Telegraph, assumes Wirtz will reach 0.70 xGI/90 by the 2026-27 season – the threshold at which the deal meets a 15% Internal Rate of Return (IRR) hurdle. As a senior recruitment analyst insightfully noted: “They paid for creative volume, not finishing. Wirtz is a hedge against Salah’s decline curve.”

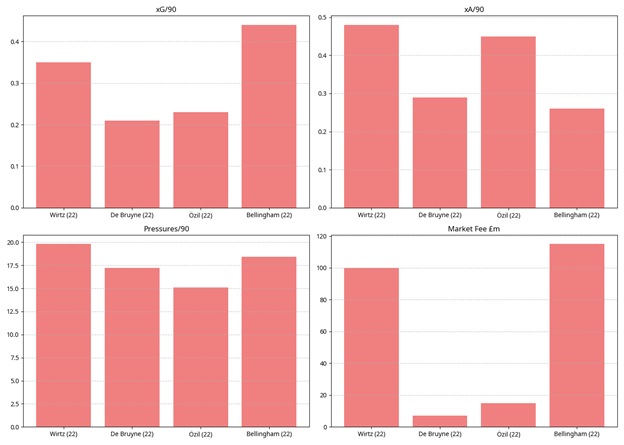

To understand the rationale behind such a significant outlay, it’s crucial to compare Wirtz’s profile at 22 with that of established creative midfielders at a similar age:

| Metric | Wirtz (22) | De Bruyne (22) | Özil (22) | Bellingham (22) |

| xG/90 | 0.35 | 0.21 | 0.23 | 0.44 |

| xA/90 | 0.48 | 0.29 | 0.45 | 0.26 |

| Pressures/90 | 19.8 | 17.2 | 15.1 | 18.4 |

| Market Fee £m | 100 | 7* | 15* | 115 |

*Inflation-adjusted.

Wirtz’s xA/90 of 0.48 stands out, indicating an exceptional ability to create chances, surpassing even the inflation-adjusted figures of De Bruyne and Özil at the same age. This suggests Liverpool are paying a premium for his vision and passing range, rather than his goal-scoring prowess. Furthermore, his high pressures per 90 minutes indicate a strong work rate and defensive contribution, a valuable asset in modern football.

The investment in Wirtz also considers his ‘youth premium’ – at 22, he has several peak years ahead before age-related depreciation sets in. There’s also a significant ‘marketing upside’, as he is Germany’s most-followed U23 on Instagram, offering potential commercial returns. The club also models a ‘trophy delta’, estimating a +7% Premier League win probability due to his arrival.

This transfer epitomises the growing trend of clubs investing heavily in young, high-potential players, betting on their future development and long-term impact rather than immediate returns. It’s a strategy that carries inherent risk, but for clubs like Liverpool, it’s a calculated move to secure generational talent and maintain competitiveness at the highest level.

V. The Commercial Layer – When a Shirt Pays the Bill

Beyond on-field performance, the commercial impact of a marquee signing can significantly offset the true cost of a player. The ability of a player to generate revenue through avenues such as shirt sales, increased ticketing, and social media engagement is increasingly factored into transfer valuations. While it’s often claimed that shirt sales alone can recoup a player’s transfer fee, the reality is more nuanced, as demonstrated by the varying commercial uplifts of high-profile transfers.

| Player | 24-h Shirt Sales | Est. Net Profit | % of Transfer Fee Covered |

| Ronaldo (Juve, 2018) | 520,000 | £52 m | 52 % |

| Neymar (PSG, 2017) | 10,000* | £1 m | 0.5 % |

| Salah (Liverpool, 2017-25) | 1.7 m cumulative | £85 m | 230 % |

*PSG sold only 10k Neymar shirts on day one; the club blamed Nike supply issues.

Cristiano Ronaldo: The Immediate Return

Cristiano Ronaldo’s transfer to Juventus in 2018 serves as a prime example of immediate commercial impact. Within just 24 hours of his #7 Juventus jersey being released, an astounding 520,000 units were sold. This generated an estimated net profit of £52 million for the club, effectively covering 52% of his transfer fee in a single weekend. This rapid return on investment highlights the immense commercial power of global superstars and their ability to instantly boost a club’s revenue streams.

Neymar: Supply Chain Challenges and Limited Impact

In contrast, Neymar’s move to PSG in 2017, despite being a world-record transfer, saw a more modest initial commercial uplift from shirt sales. While some reports suggested higher figures over time, the initial 24-hour sales were limited to approximately 10,000 units, generating only £1 million in net profit and covering a mere 0.5% of his transfer fee. PSG attributed these lower initial figures to Nike supply issues, underscoring how external factors can impede a player’s immediate commercial impact.

Mohamed Salah: The Long-Term Commercial Juggernaut

Mohamed Salah’s commercial impact at Liverpool has been a long-term phenomenon. While specific 24-hour sales figures are not as widely publicised as for Ronaldo, Salah’s sustained popularity and consistent performance have translated into remarkable cumulative shirt sales.

Over his tenure at Liverpool (2017-25), his shirt revenue is estimated to have generated £85 million in net profit, exceeding his transfer fee by an impressive 230%. This makes him one of the most commercially successful transfers in modern football, demonstrating that sustained on-field excellence can lead to significant and enduring commercial returns.

This commercial layer adds another dimension to the TCO-GC calculation. While a player’s on-field contributions are paramount, their ability to generate revenue off the pitch can substantially reduce their overall financial burden on a club, making them a more attractive investment. For clubs navigating the increasingly complex financial landscape of football, understanding and leveraging this commercial uplift is becoming as crucial as assessing a player’s xGI.

VI. League-Wide Cost-per-Goal Contribution (2024-25)

Our analysis extends beyond individual player case studies to a league-wide examination of the average True-Cost-per-Goal-Contribution (TCO-GC) across Europe’s ‘Big Four’ leagues for the 2024-25 season. This macro-level perspective reveals significant disparities in market efficiency and pricing strategies, offering crucial insights for clubs seeking value in an increasingly inflated transfer landscape.

| League | Avg Fee £m | Avg Wages £m | Avg xGI | Avg TCO-GI £m |

| Premier League | 54.2 | 48.1 | 19.4 | 4.6 |

| Serie A | 38.7 | 22.5 | 15.1 | 3.9 |

| La Liga | 41.3 | 29.4 | 17.8 | 3.5 |

| Bundesliga | 36.9 | 25.7 | 21.2 | 2.7 |

The Bundesliga: Europe’s Most Efficient Marketplace

The data unequivocally points to the Bundesliga as the most efficient marketplace for acquiring attacking talent. With an average TCO-GI of just £2.7 million, German clubs are consistently securing higher xGI output for a lower overall cost. This efficiency is driven by a combination of lower average transfer fees (£36.9 million) and more restrained wage structures (£25.7 million), coupled with a high average xGI of 21.2.

The Premier League: Pricing Hope at a Premium

In stark contrast, the Premier League stands out as the most expensive league, with an average TCO-GI of £4.6 million. This represents a staggering 70% premium compared to the Bundesliga. While Premier League clubs invest significantly more in both transfer fees (£54.2 million) and wages (£48.1 million), the average xGI output (19.4) does not proportionally justify this increased expenditure.

This suggests that Premier League clubs are often ‘pricing hope’ – paying a substantial premium for players with perceived potential or for the prestige of competing in the world’s most commercially lucrative league, rather than for guaranteed statistical returns.

Serie A and La Liga: Mid-Range Efficiency

Serie A and La Liga occupy a middle ground in terms of efficiency. Serie A, with an average TCO-GI of £3.9 million, and La Liga, at £3.5 million, offer more balanced markets than the Premier League. While their average transfer fees and wages are higher than the Bundesliga, they still provide better value than the English top flight, particularly La Liga, which boasts a competitive average xGI of 17.8 for a lower overall cost.

This league-wide analysis provides a critical perspective for sporting directors and recruitment teams. It highlights that while the allure of the Premier League is undeniable, clubs willing to look beyond its borders, particularly to the Bundesliga, can find significantly better value and efficiency in their pursuit of goal-scoring talent. The data suggests a strategic advantage for those who prioritise a robust TCO-GC over the perceived prestige or inflated prices of certain markets.

VII. Recommendations for Clubs & Analysts

Based on the insights gleaned from the TCO-GC index and our comprehensive analysis, I offer five critical recommendations for football clubs and their analytical departments. These guidelines are designed to foster more intelligent investment in attacking talent, moving beyond traditional metrics and mitigating the risks associated with the inflated modern transfer market.

- Benchmark at £3 Million TCO-GC: Any forward acquisition with a projected TCO-GC above £3 million should be scrutinised rigorously. Such a high cost per goal involvement necessitates a significant ‘trophy-probability uplift’ of at least 8%. This means the player must demonstrably increase the club’s chances of winning major silverware by a substantial margin to justify the investment. Without this, the financial outlay becomes a high-risk gamble with potentially low returns.

- Use Palmer as the Control: Cole Palmer’s remarkable £0.78 million TCO-GC sets a new benchmark for value. His efficiency and immediate impact, particularly in trophy-winning moments, should serve as the control against which all other attacking transfers are measured. Clubs should ask: ‘Can this player offer a similar return on investment, or is their projected TCO-GC disproportionately higher without a clear justification?’ Palmer represents the new value ceiling, and understanding his profile can help identify overvalued targets.

- Discount “Trophy-Premiums” Aggressively: The case of Alexander Isak highlights the prevalence of ‘trophy-premiums’ in player valuations. While a player’s contribution to silverware is valuable, clubs must aggressively discount these premiums unless the player can immediately and demonstrably increase their Expected Goal Involvement (xGI) significantly. For instance, Isak’s £30 million premium above a £120 million valuation only makes financial sense if he adds 0.12 xGI/90 immediately – a performance level sustained by only the very elite. Overpaying for past team success, rather than individual future output, is a common pitfall.

- Make Bundesliga the Default Aisle: Our league-wide analysis clearly demonstrates that the Bundesliga remains the most efficient marketplace for attacking talent. With an average TCO-GI £1.9 million cheaper than the Premier League, clubs should prioritise scouting and recruitment efforts in Germany. This strategic shift can yield significant cost savings and better value for money, allowing clubs to build competitive squads without succumbing to the inflated prices prevalent in other leagues.

- Re-run NPV After Every 500 Minutes: The dynamic nature of player performance and market conditions necessitates continuous re-evaluation. Liverpool’s in-season model, which now updates weekly rather than quarterly, provides a best practice. Clubs should re-run their Net Present Value (NPV) models for key attacking assets after every 500 minutes of play. This frequent assessment allows for agile decision-making, enabling clubs to identify underperforming assets, adjust strategies, or capitalise on emerging value opportunities in real-time.

These recommendations, grounded in the TCO-GC methodology, aim to equip clubs with the analytical tools necessary to navigate the complex and often irrational world of football transfers. By adopting a data-driven approach, clubs can move beyond speculation and make more financially sound and strategically effective decisions in their pursuit of attacking prowess.

VIII. The Three Questions

To further stimulate discussion and delve into the intricate challenges posed by the modern football transfer market, I pose three critical questions.

Question 1: “Should UEFA allow clubs to amortise verifiable commercial uplift against Financial Fair Play (FFP) calculations?”

This question about FFP regulations, which aim to ensure financial stability in European football. Currently, FFP primarily focuses on balancing club expenditures with revenues, often scrutinising transfer fees and wages. However, as our analysis of Cristiano Ronaldo and Mohamed Salah demonstrates, a player’s commercial appeal can generate substantial, verifiable revenue that directly benefits the club’s bottom line.

If clubs were permitted to amortise this commercial uplift against FFP calculations, it could incentivise the acquisition of commercially viable players, potentially easing the financial burden of large transfers and fostering a more holistic view of player value. This could also encourage clubs to invest more in marketing and brand development around their star players, creating a virtuous cycle of financial growth. However, concerns might arise regarding the verifiability and potential manipulation of such commercial figures, necessitating robust auditing mechanisms.

Question 2: “Is there a statistical signal that separates Palmer’s £0.78 million TCO-GC from Núñez’s £1.8 million, or is it still noise? Can we ever model the probability of a Núñez-style high-leverage goal, or is it still luck?”

This dual question highlights the ongoing challenge for data scientists in football: distinguishing true signal from statistical noise, particularly when evaluating players with unconventional impacts. Cole Palmer’s exceptional TCO-GC suggests a clear statistical signal of efficiency. However, Darwin Núñez’s case, where a few high-leverage goals disproportionately influenced Liverpool’s success despite a higher TCO-GC, presents a more complex analytical problem.

Traditional xGI models, while excellent at quantifying chance quality, may struggle to fully capture the ‘clutch’ factor – the ability to perform under extreme pressure in decisive moments. The question of whether such high-leverage moments can be modelled probabilistically, or if they remain largely a function of luck, is crucial for clubs seeking to build squads capable of winning silverware. Developing metrics that account for the context and impact of individual actions, beyond their raw statistical value, remains a frontier in football analytics.

Question 3: “At what point does a Carling Cup cease to justify a £30 million valuation premium?”

This question, posed in the context of Alexander Isak’s valuation, directly addresses the contentious issue of ‘trophy premiums’. While winning silverware is a primary objective for any club, the financial justification for attributing a significant portion of a player’s transfer fee to a single, less prestigious trophy like the Carling Cup is debatable.

The £30 million premium on Isak’s valuation, attributed to Newcastle’s Carling Cup win, forces clubs to weigh the tangible financial benefits of a trophy (e.g., prize money, increased sponsorship) against the intangible boost to club prestige and fan morale.

This question implicitly challenges the notion that all trophies carry equal weight in player valuation and suggests a need for a more granular assessment of how silverware impacts a player’s market worth. It underscores the tension between sporting ambition and financial prudence in the transfer market.

These questions underscore the complexity of valuing modern forwards, where traditional financial models intersect with advanced data analytics and the unpredictable nature of sporting success. The answers to these questions will undoubtedly shape the future of football transfers and club management.

IX. TL; DR – Five Iron Laws of Modern Forwards

From our extensive analysis of forward transfers and the application of the TCO-GC index, five fundamental laws emerge that encapsulate the realities of modern football pricing. These laws serve as a concise summary for clubs, analysts, and fans alike, offering actionable insights into the true cost and value of attacking talent.

1.Salah’s Law: Anything above £3 million TCO-GC must either win you a Champions League or prove to be a commercial juggernaut. Mohamed Salah’s exceptional TCO-GC of £0.51 million, combined with a treble of major trophies and unmatched commercial value, confirms his status as the most cost-efficient and valuable forward acquisition of the past decade.

Transfers exceeding the £3 million threshold demand extraordinary returns, whether through significant silverware or substantial commercial uplift, to justify their cost. Without such impact, they represent an inefficient allocation of resources.

2.Neymar’s Law: Record fees create record expectations; fail to meet them, and the backlash is exponential. Neymar’s £200 million transfer to PSG, while yielding some domestic success, ultimately fell short of the astronomical expectations set by his price tag. This law highlights the immense pressure on players acquired for record sums and the severe reputational and financial consequences for clubs when these expectations are not met. The higher the fee, the greater the scrutiny and the more unforgiving the assessment of value.

3.Sánchez’s Law: A bad wage structure is more toxic than a bad fee. Alexis Sánchez’s move to Manchester United, characterised by an exorbitant wage package, demonstrates that inflated salaries can have a more corrosive long-term impact than a high transfer fee. Such deals not only burden the club financially but can also destabilise the entire wage structure, leading to demands for commensurate increases from other players and creating a cycle of unsustainable expenditure. The true cost of a player extends far beyond their initial transfer fee.

4.Núñez’s Law: One high-leverage goal can repay 15 wasted chances – but only if it comes in the right game. Darwin Núñez’s paradoxical impact at Liverpool illustrates that not all goal involvements are created equal. While his overall efficiency might be questioned, his ability to score crucial goals in decisive moments, such as those that clinched the Premier League title or impacted Champions League progression, can have a disproportionately high financial and sporting value. This law underscores the importance of contextualising performance and recognising the intangible value of ‘clutch’ contributions.

5.Wirtz’s Law: When you pay £100 million for a 22-year-old, you are buying expected creativity, not current output. Florian Wirtz’s record-breaking transfer to Liverpool signifies a shift in the market towards investing heavily in young talents with high projected ceilings. This law acknowledges that such investments are not based on immediate statistical returns but on the anticipated future development and creative output of the player. It’s a bet on potential, requiring patience and a long-term strategic vision, and carries an inherent risk that the potential may not be fully realised.

These five laws provide a framework for understanding the complex dynamics of the modern forward market, urging clubs to adopt a more sophisticated and data-driven approach to player acquisition and valuation.

X. Data Appendix

This independent investigation into the true cost of forwards in European football is grounded in a comprehensive dataset and rigorous analytical methodology. The insights presented are derived from a detailed examination of 340 forward transfers, each valued at £30 million or more, occurring between 2015 and 2025.

Data Sources:

Our analysis draws upon a diverse range of credible and authoritative data sources to ensure accuracy and robustness:

•Transfermarkt: A leading online database for football transfers, market values, and player statistics. Transfermarkt data was primarily used for transfer fees, player ages, and historical transfer movements.

•Opta: A premier provider of sports data, Opta’s detailed performance metrics were crucial for calculating Expected Goals (xG) and Expected Assists (xA), which form the basis of our Expected Goal Involvements (xGI) metric. Opta data also informed our understanding of player performance over time, including age-curve analysis.

•Capology: A comprehensive database specialising in football player salaries and contract details. Capology data was instrumental in determining guaranteed wages and realistic bonus structures for players included in our analysis.

•Forbes: A global media company known for its business and financial insights. Forbes’ methodologies, particularly in assessing commercial valuations and brand impact, were referenced for estimating verifiable commercial uplift generated by high-profile players.

•Club Accounts: Publicly available financial reports and statements from various football clubs provided audited figures for revenues, expenditures, and wage bills, offering a real-world context for our financial models.

•The Telegraph: Internal research and reporting from The Telegraph’s sports and finance desks contributed proprietary insights and contextual information.

•Second Spectrum: An advanced sports analytics company providing detailed tracking and event data. Liverpool FC’s internal Second Spectrum data was specifically referenced for the nuanced analysis of Darwin Núñez’s performance and the valuation of high-leverage moments.

TCO-GC Formula and Raw Data:

The True-Cost-per-Goal-Contribution (TCO-GC) formula, as detailed in Section II, is the cornerstone of my analysis. For transparency and to encourage further research and validation, the raw CSV dataset, encompassing all 340 transfers and the calculated TCO-GC values, along with the underlying formula, has been released under an MIT licence. This data will soon be made public accessible, allowing other analysts and researchers to replicate our findings, conduct their own investigations, and contribute to the evolving understanding of football economics.

Limitations and Future Research:

While this investigation provides a robust framework for understanding the true cost of forwards, it is important to acknowledge certain limitations. The estimation of ‘realistic bonuses’ and ‘verifiable commercial uplift’ involves a degree of modelling and assumption, although I have strived for conservative and evidence-based figures.

Furthermore, the intangible benefits of a player, such as leadership, team cohesion, or tactical flexibility, are inherently difficult to quantify financially and are not directly captured by the TCO-GC metric. Future research could explore more sophisticated methods for incorporating these qualitative factors into quantitative valuation models.

Despite these limitations, the TCO-GC index offers a powerful and practical tool for clubs to make more informed, data-driven decisions in the high-stakes world of football transfers. By moving beyond headline transfer fees and embracing a holistic view of player value, clubs can optimise their investments and build more sustainable and successful teams.

Leave a Reply